Tesla is the world’s 15th largest company, boasting a market cap of $415.21 billion. The company has revolutionized the automobile industry by changing the public perception of EVs and introducing technology and clean power. Let’s try to understand how to form a blue ocean advantage around a hated product through the Tesla SWOT analysis.

Tesla: Company Overview

| Company | Tesla Inc. |

| Industry | Automobile, Renewable energy |

| Founded | 1 July, 2003 |

| Founder | Elon Musk, Marc Tarpenning, Martin Eberhard, Ian Wright, JB Straubel |

| CEO | Elon Musk |

| Headquarter | 13101 Tesla Road, Austin, Texas, U.S. |

| No. of Employees | 110,000+ |

| Annual Revenue | $53.8 billion (FY 2021) |

| Website | tesla.com |

Tesla was incorporated as Tesla Motors by Co-Founders Martin Eberhard and Marc Tarpenning in 2003 in San Carlos, California. The company was created with the dream of creating an electric sports car, only based on General Motors’ 1996 – 1999 EV1 experiment. The company announced the Roadster in 2006 but failed to manufacture it commercially till 2008. The company was on the verge of sinking by 2009, with only $10 million cash and more cars to make than they possibly could.

Tesla has made a miraculous recovery since then and thrived as a US multinational automotive and clean energy company. It’s headquartered in Austin, Texas, with 19 factories worldwide, 4 of which are dedicated to producing Tesla EVs only. The company made $74.86 billion in revenue in 2022 and currently has a stock price of $131.49. To date, the company has 3 million electric cars, with over 900,000 cars sold in 2022.

Product & Services of Tesla, Inc.

Electric Vehicles | Batteries for Energy Storage | Solar Panels

Tesla Competitors

Nio | Ford Motors | Volkswagen | General Motors | Nissan | Honda

Did You Know?

Tesla’s first EV, the Roadster, was commercially made available in 2008, and it almost sunk the company. Tesla had to take a $465 million loan from the US Department of Energy in 2010 to stay afloat. The company paid it back by 2013, 9 years earlier than allotted.

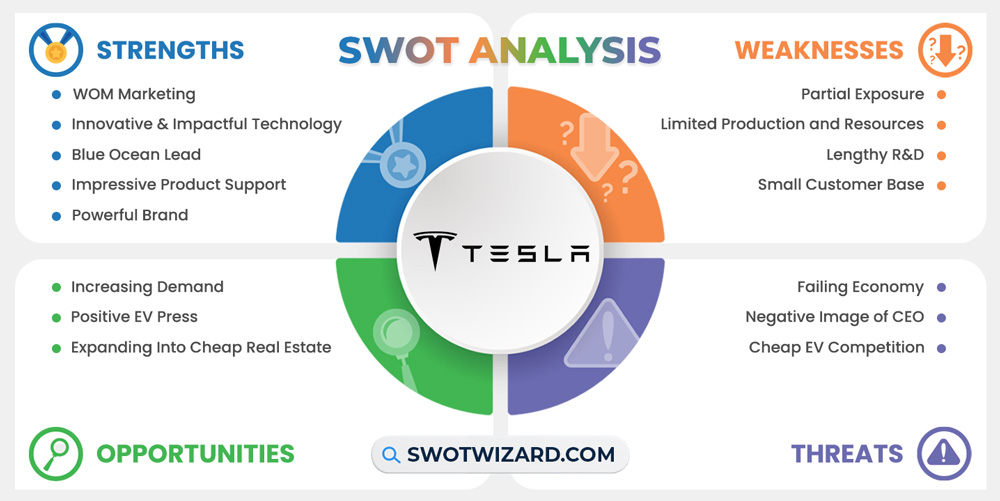

Strengths – Tesla SWOT Analysis

WOM Marketing: From the company’s inception, Tesla has mostly used word of mouth to market itself. The company draws attention through its unique products, and the CEO’s presence on social media gains customers through quality customer experience and a referral program. It also promotes itself using its sister companies, such as launching a Tesla car into space using SpaceX. This marketing style creates a devoted customer base and costs nearly nothing.

Innovative & Impactful Technology: Tesla’s products are always based on innovative and environment-friendly technology. Tesla is committed to producing and using clean energy, and its technology promises to impact the earth positively. In an age with rising concerns about environmental pollution and global warming, Tesla’s product lines seem like a solution for both.

Blue Ocean Lead: When the company introduced the Tesla Roadster, only 40% of Americans showed passing interest in driving an electric car, and no one was making one. And in 2019, Tesla broke records with 200,000 pre-orders for the Cybertruck. Tesla’s impact is forcing other car manufacturers to compete with it for market share. However, because Tesla already has an established customer base, supply chains, and R&D, it will always stay ahead.

Impressive Product Support: Tesla’s most powerful advantage is that it can keep upgrading its products with features even after it has left the production line. Since Model S Long-range launched in 2012, it’s been updated to increase its range by 50%, from 265 miles to 405 miles. Tesla has over 3,500 supercharger stations worldwide, running fully on renewable energy. This commitment to supporting its cars sets it apart from other car manufacturers.

Powerful Brand: Tesla’s brand image is more powerful than its competitors. Since day one, Tesla’s products and statements went against the traditional car market. Its marketing stunts are legendary for showing off its products’ true impact. It’s credited for making the electric vehicle market feasible and giving electric cars a premium status. And the CEO is credited with listening to genuine feedback and hashing out updates in months.

Weaknesses – Tesla SWOT Analysis

Partial Exposure: While Tesla is known as a premier automaker, very few know that the company also provides clean energy solutions. Tesla has worked hard to deploy a vertically integrated energy and transportation ecosystem that helps the customer’s power grid become self-sufficient and run on clean energy. Yet, the company has seen very low exposure to such technology.

Limited Production and Resources: Tesla’s growth is limited by its limited resources and long production time. By December 2021, 99,290 employees were working at the company, compared to 366,283 of Toyota. Tesla’s factories in Austin, Texas, and Fremont, California, can only produce 900,000 vehicles annually. Combined with a drive for perfection, Tesla took over 10 years to launch Model 3, a car the company kept mentioning since 2006.

Lengthy R&D: Tesla stays in the lead of automakers with its advanced features, but it takes years of research and development. While Tesla can update car software afterward, it has to think years ahead and provide the cars with the hardware to keep up. For example, Tesla provided every model after October 2016 with autopilot and self-driving, but cars sold as far back as September 2014. This foresight is commendable, but required rigorous research that held back product launches.

Small Customer Base: Because Tesla mostly gets its business through WOM marketing, the actual customer base for the company is quite small. Tesla held 68% of the EV market share in 2021, but it has been selling to the same customers. A survey in 2016 found that 92% of Tesla owners were committed to buying a newer model, and only 24% would consider owning gas-powered cars.

Opportunities – Tesla SWOT Analysis

Increasing Demand: By 2021, the US demand for gasoline-powered cars regressed to 44.9%, while the interest in electric vehicles increased to 22.9%. This increased interest is 8 times higher than the current customer base of the EV market. Tesla can use this opportunity to produce and sell more of its available models.

Positive EV Press: Recent discussions of environment protection and resource management have put a spotlight on the EV market. The media has been marketing electric vehicles and how these can reduce carbon footprint. Tesla can market its environmental impact more and draw new customers in.

Expanding Into Cheap Real Estate: Tesla has already made working prototypes of tiny houses fully powered by clean energy, and off the grid. With the economic fall, and rising real estate prices, Tesla can sell these units to those who are happy with a cheap, functional, cost-saving, but cozy living space.

Threats – Tesla SWOT Analysis

Failing Economy: Tesla has always been a premium automaker with high car prices. Model 3 was marketed as an EV for the masses, but it still cost $45,000 without options. In a market with strained international relationships and low purchasing power, Tesla may not see enough customers to sustain itself.

Negative Image of CEO: CEO Elon Musk has given press time and time again to Tesla through social media. Unfortunately, being tied so closely to the CEO’s public image has caused Tesla some grief. Elon Musk’s recent fiasco with buying and modifying Twitter, firing employees, and changing policies has upset the internet. People can refuse to buy Tesla and support Elon Musk, which will impact the company’s revenue.

Cheap EV Competition: Tesla, by its business model, is unable to create cheap car models. On the other hand, traditional automakers like Nissan, Honda, and Toyota have been pushing out cheap EVs that everyone can access, with decent enough specifications to attract customers. A 2023 Nissan Leaf can cost as low as $20,540, and models like these have been choking out Tesla’s market share.

[Bonus Infographic] SWOT Analysis of Tesla

Recommendations for Tesla, Inc.

Tesla has created and monopolized the EV market in the US since 2011, but it’s slowly losing its hold. If it doesn’t want other automakers to take its space away, then it should consider these suggestions.

- Tesla should begin using passive marketing techniques, such as product placements or paid car reviews.

- Tesla can forgo futureproofing every model it sells and push out newer models faster.

- The company can invest in its own self-driving taxi platform, which would be a blue ocean variant of services like Uber.

- Tesla can focus on creating subscription systems for features such as autopilot. This will enable a larger consumer base to access the service, and Tesla will have a consistent income source.

- Tesla can start selling its tiny houses and alternative construction products and services to smaller countries such as Bhutan, Bangladesh, Nepal, and more.

Frequently Asked Questions (FAQs)

How long do Tesla’s batteries last?

Tesla’s batteries will run in good health for 300,000 to 500,000 miles.

How much does a Tesla cost to maintain?

Tesla cars can cost an average of $832 per year to maintain.

Final Words on Tesla SWOT Analysis

Tesla is the iconic example of 0 cost marketing and the blue ocean advantage. It has caused a paradigm shift in public perception about electric cars and transformed the concept from atrocious to desired. However, Tesla’s competitors have begun to catch up, and they are riding on their cheap bracket’s success. Now more than ever, Tesla needs to reinvent itself and push for growth, or it will only be glorious EV history.

References

- Wikipedia contributors. (n.d.). Tesla, Inc. Wikipedia.

- Which Tesla models have autopilot? (2021, September 13). SUVCult.

- Brown, B. (2019, November 26). This Chart Shows Why Tesla Is Destroying Traditional Car Companies. CCN.

- Brown, K. (2022, November 4). How Many Cars Has Tesla Sold? U.S. News.

- Carlier, M. (2022b, August 2). Number of Tesla employees from July 2010 to December 2021. Statista.

- Carlier, M. (2022a, July 21). Consolidated number of Toyota Motor Corporation employees from FY 2012 to FY 2022. Statista.

- Tesla (TSLA) – Revenue. (n.d.). CompaniesMarketCap.

- Crider, J. (2020, March 16). This Is Why Traditional Automakers Should Be Terrified Of Tesla. CleanTechnica.

- Desjardins, J. (2016, September 29). 41 Interesting Facts About Tesla Motors. Visual Capitalist.

- Gloria Ryan, E. (2022, November 24). Elon Musk’s Twitter Fiasco Is the Twilight of the Tech Bro. Yahoo.

- Gold, A. (2023, January 16). How Tesla Probably Cut the Model 3’s Price to $45,000. MotorTrend.

- Guy, M. (2021, March 14). How long does Tesla take to launch a car? We plot the timelines across 5 models. Driving.

- Hogan, M. (2018, April 13). Social Media Highlight: Tesla and Elon Musk. Stunning Strategy.

- Howard, B. (2021, October 8). Survey: 23% Of Americans Would Consider EV As Next Car. Forbes.

- Kane, M. (2016, May 2). Survey: 92% Of Tesla Owners Will Buy Tesla Again, 55% To Purchase A Model 3. InsideEVs.

- Lambert, F. (2022, August 15). Tesla (TSLA) still dominates US electric car market with 68% market share. Electrek.

- 2011 Tesla Roadster 2.5 S Review. (2010, October 12). AutoGide.

- Munster, G. (2022, April 22). Tesla Is Putting Way More Than Traditional Auto in Trouble. Loup.

- 2023 Nissan LEAF | All-Electric Vehicle. (n.d.). Nissan USA.

- Olinga, L. (2022, December 18). Tesla’s New Factory Location Revealed. TheStreet.

- Reed, E. (2020, February 4). History of Tesla: Timeline and Facts. TheStreet.

- Tesla Tiny House Marketing Page. (n.d.). Tesla.

- Solar Roof. (n.d.). Tesla.

- Tesla 2021 Impact Report. (n.d.). In Tesla.

- Impact | Product. (n.d.). Tesla.

- Solar Panels. (n.d.). Tesla.

- Vega, N. (2020, October 8). Tesla Roadster launched into space by SpaceX passes Mars. New York Post.