Coles has been Autralian’s go-to supermarket to find everything they need, and it has always been for decades. They cater to millions with a wide presence and around three thousand stores.

In the company’s long history, Coles has overcome many threats and weaknesses, not to mention the opportunities they grabbed along the way with strengths which we will get to know in this Coles swot analysis.

Coles: Company Overview

| Company | Coles Supermarkets Australia Pty Ltd |

| Industry | Retail |

| Founded | 9 April, 1914 |

| Founder | George Coles |

| CEO | Leah Weckert |

| Headquarter | Hawthorn East, Victoria, Australia |

| No. of Employees | 112,269+ |

| Annual Revenue | A$38.175 billion (FY 2019) |

| Website | coles.com.au |

Just before the first world war, the company started its journey in 1914 by George Coles in Collingwood, Victoria, and in 110 years, it has grown to become one of the biggest names in the supermarket space.

Coles has approximately 120,000 employees and generated a total revenue of AUD 39.37B in 2022. The company’s net profit after tax in 2022 was over one billion. Coles aims to be the most trusted retailer in Australia, providing customers with high-quality products and services while prioritizing sustainability and supporting Australian farmers and producers.

Product & Services of Coles

Consumer Products | Fuel Products | Alcohol | Financial Services

Coles Competitors

Carrefour | Tesco | LIDL | Woolworths | Walmart | Kroger | Target | Amazon

Did You Know?

Coles removed single-use plastic bags from all its stores, estimated to have saved over 1.5B loads from entering the environment.

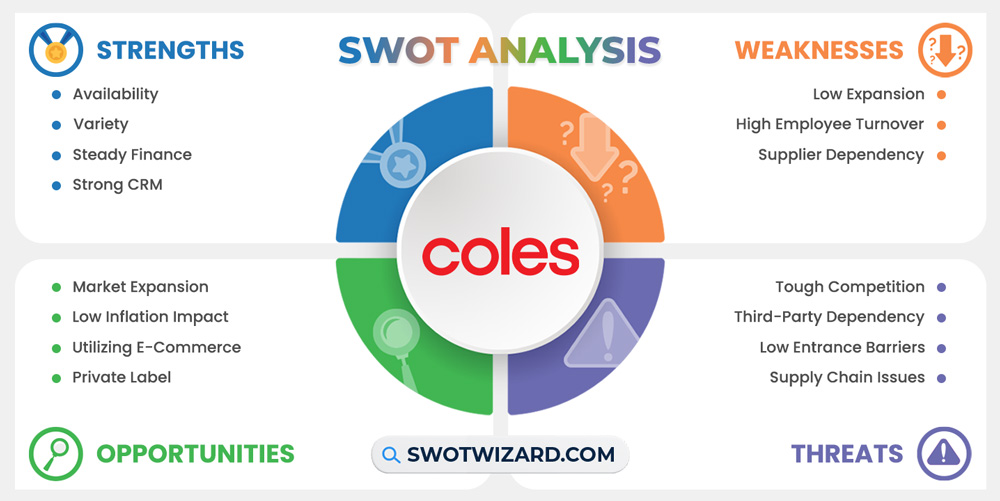

Strengths – Coles SWOT Analysis

Availability: With over 2,500 stores nationwide, including supermarkets, liquor stores, and convenience stores, Coles has a widespread availability of products. Besides, they offer customers a convenient way to purchase online and aim to have 97% of all products in stock at any given time, ensuring that customers can find what they need.

Variety: People want convenience and everything they need in one place, reducing hassle and time. To ensure variety, Coles offers various products, including fresh produce, meat, bakery items, deli products, groceries, and household essentials. Not to mention their wide variety of international and specialty foods, such as Asian, Mexican, and Italian ingredients, and more than 45k online products have helped them become famous.

Steady Finance: The company reported a 2.03% increase in revenue to $39.37B, with a net profit of over $1B in 2022 and maintaining steady financial performance over the years. Besides, a healthy dividend payout ratio of 75.29% reflects its commitment to returning value to shareholders.

Strong CRM: Adopting effective and efficient tech, such as using data analytics to understand customer behavior and preferences better, allows them to tailor promotions and offers to individual customers. And because of that, they can provide personalized rewards through their Flybuys program, which has over 8.6M members.

Weaknesses – Coles SWOT Analysis

Low Expansion: The company has a relatively low presence and expansion outside Australia. While Coles is a major player in the Australian retail market, it has a limited international presence compared to some of its competitors, making it vulnerable to depending on a single market and its economic downfalls.

High Employee Turnover: High employee turnover can increase recruitment and training costs, and Coles is already facing these issues. As the report says, Coles’ staff turnover rate was around 35%, higher than the industry average, leaving the company with a considerable staff shortage. And there are reasons behind that, as the employees suffer work pressure and anxiety.

Supplier Dependency: Like all the supermarkets worldwide, Coles also heavily depends on suppliers for its products. As a result, any disruptions in the supply chain can impact its ability to meet customer demand. In the last year, 2022, the company faced ‘enormous’ supply chain issues from the suppliers’ end, and even now, in 2023, they are facing threatening problems that can collapse the entire supply chain.

Opportunities – Coles SWOT Analysis

Market Expansion: Coles could explore opportunities to expand internationally, particularly in the Asia-Pacific region, with significant growth potential. In the Asia Pacific region, the supermarket industry is booming with a considerable growth rate, not to mention the chart indicates the same growth opportunities worldwide.

Low Inflation Impact: Australia’s low inflation impact presents an opportunity for the supermarket chain to offer competitive pricing to customers and increase sales. According to data, inflation in Australia now stands at 6.8%% in 2023, whereas the rest of the world’s economy faces massive downturns.

Utilizing E-Commerce: Coles has been utilizing e-commerce to enhance its customer experience and expand its reach, which is shown in the data as an online shopping service has seen significant growth, with online sales up by 45% in 2022. Besides, the smart selling strategy has boosted the overall revenue, especially online shopping, by a vast margin.

Private Label: Coles can continue expanding its private label products, often more profitable than branded products. The company could include launching new product lines in other countries with considerable demands, such as Singapore, or growing existing ones to meet customers’ changing needs.

Threats – Coles SWOT Analysis

Tough Competition: Coles faces tough competition in the Australian retail market, particularly from its primary competitor, Woolworths. According to the data, Coles and Woolworths account for over 60% of the Australian supermarket industry’s revenue. In addition to Woolworths, Coles faces competition from discount retailers like Aldi and Kmart, which are gaining market share in Australia.

Third-Party Dependency: According to Cole’s 2022 Annual Report, over 80% of Coles’ stores are leased, which means they depend on landlords for their store locations. Additionally, Coles relies heavily on third-party providers for logistics, distribution, and other services, like Toll and Linfox, to manage their supply chain.

Low Entrance Barriers: The low entrance barriers make it easier for new players to enter the market and compete with established players like Coles. The Australian supermarket industry has low entrance barriers, relatively low capital requirements, and easy obtaining necessary licenses and permits, leading to increased competition in the market, particularly from discount retailers such as Aldi and Kmart.

Supply Chain Issues: Coles has faced several supply chain issues recently. In 2020, the company faced product shortages and supply chain disruptions due to panic buying during the COVID-19 pandemic. And these supply chain issues have always been a tail for the company, as it is going through supply chain disruptions, and consumers are seeing empty shelves.

[Bonus Infographic] SWOT Analysis of Coles

Recommendations for Coles

Here are some recommendations for Coles to grow and survive long-term.

- Their priority should be to expand to other regions, such as Asia and Europe, as soon as possible.

- E-commerce is the name of the game these days, and Coles should fully utilize the entire online purchasing experience for the customers.

- They should work on reducing suppliers’ dependency and overcoming supply chain issues.

- Most supermarkets are doing it and should also expand the private label brand lines.

Frequently Asked Questions (FAQs)

Who is Coles Owned by?

Coles is owned by Wesfarmers.

What is the Full Name of Coles?

The full name of Coles is Coles Supermarkets Australia Pty Ltd.

Final Words on Coles SWOT Analysis

Coles is a well-established supermarket chain in Australia with a strong market position and a reputation for quality products and services. By utilizing e-commerce to enhance the customer experience, the company expanded its reach and grew this big. Although they are facing issues like supply chain and third-party and supplier dependency, there is nothing they can’t overcome and grow in the coming days.

References

- Wikipedia contributors. (n.d.). Coles Supermarkets. Wikipedia.

- Coles shopper saving hundreds a year with this hack. (2023, March 22). Yahoo.

- Butler, B. (2022, January 19). Chronic staff shortages, 2am starts and extreme anxiety: inside a Coles supermarkets supply warehouse. The Guardian.

- Rose, D. (2022, April 28). Coles says supply chain issues “enormous.” 7NEWS.

- Hannam, P. (2023, March 29). Australia’s annual inflation rate falls to 6.8% fuelling hopes cost of living pressures are easing. The Gurdian.

- Smith, R. L. (2006). The Australian grocery industry: a competition perspective. Australian Journal of Agricultural and Resource Economics, 50(1), 33–50.