Buffalo Wild Wings, the iconic American brand, continues to serve tens of millions of wings to guests globally in a unique, welcoming setting blending sports fandom and bar fare. And we will learn about its business aspects in this Buffalo Wild Wings SWOT analysis.

Buffalo Wild Wings: Company Overview

| Company | Buffalo Wild Wings |

| Industry | Restaurants |

| Founded | 1982 |

| Founders | Jim Disbrow, Scott Lowery |

| CEO | Paul Brown |

| Headquarter | Atlanta, Georgia, U.S. |

| No. of Employees | 44,000+ |

| Annual Revenue | $3.669 billion (FY 2020) |

| Website | buffalowildwings.com |

Around 40 years ago, Buffalo Wild Wings was founded in 1982 in Columbus, Ohio, as a wings-focused sports bar. After rapid growth, it expanded to over 1,200 locations across 10 countries by 2023.

The franchise has seen incredible popularity around televised sports games and achieved cult status for its wing recipes and lively atmosphere. Buffalo Wild Wings generated $2B in total revenue in 2023 and employs over 44,000 team members today.

Product & Services of Buffalo Wild Wings

Chicken Wings | Shareables | Burgers | Beer

Buffalo Wild Wings Competitors

McDonald’s SWOT Analysis | Darden Restaurants | Chipotle | Jack in the Box | Hooters | Applebee’s | Dennys

Did You Know?

The Wall of Flame hot sauce challenge, involves signing a waiver before trying wings loaded with their hottest sauce, and less than 17% complete it yearly.

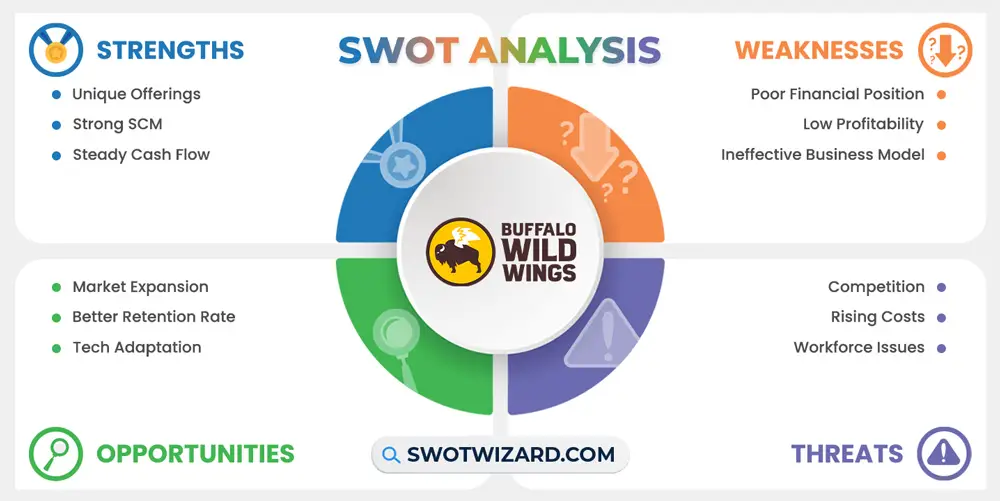

Strengths – Buffalo Wild Wings SWOT Analysis

Unique Offerings: The company has built its brand around a unique chicken wings and sauces offering. With over 26 signature sauces and seasonings, it offers one of the widest varieties of any restaurant chain, giving customers options and driving repeat business. In 2023, Inspire Brands reported Buffalo Wild Wings served over 775 million traditional wings.

Strong SCM: With over 1,257 locations globally, Buffalo Wild Wings has built an efficient supply chain to move high volumes of wings across its restaurants. As reported in 2023, 99.8% of total restaurant spending was with approved national and regional distributors, allowing Buffalo Wild Wings to leverage economies of scale.

Steady Cash Flow: Despite challenges in 2020 due to the pandemic, Buffalo Wild Wings generated $834M in total revenue and $123M in adjusted EBITDA in 2023 as dine-in demand recovered. The loyalty of its customer base and focus on delivery and takeaway provide resilient cash flow through ups and downs. Its scale also gives better access to capital.

Weaknesses – Buffalo Wild Wings SWOT Analysis

Poor Financial Position: Buffalo Wild Wings has taken on substantial debt loads in recent years, which have increased interest expenses and debt servicing costs. As of 2023, total debt was $958M, reducing flexibility. Besides, interest expenses totaled $94M, diverting capital from growth.

Low Profitability: Despite steady revenue growth pre-pandemic, net margins for Buffalo Wild Wings have remained relatively thin in the competitive casual dining space, at only 2-5% historically. In 2023, net earnings were just $50M on $834M in sales, and reliance on commodity ingredients squeezes margins.

Ineffective Business Model: As a sports bar and dine-in focused concept, Buffalo Wild Wings was vulnerable during the pandemic when locations were closed or restricted. A late pivot to robust delivery and digital platforms led to a 13% sales decline in 2020 before rebounding, revealing gaps in its business model adaptability.

Opportunities – Buffalo Wild Wings SWOT Analysis

Market Expansion: With over 1,200 locations, Buffalo Wild Wings still has ample room for continued expansion, especially internationally, where wing consumption is growing. In 2022, just 82 locations were abroad, and tapping new markets could fuel growth for years.

Better Retention Rate: Buffalo Wild Wings sees high repeat dining rates of about 30%, and it indicates one thing, which is focusing on a better loyalty program with targeted offers based on consumer data could raise retention further. In 2023, the number of app members enrolled in Blazin Rewards increased by over 140%.

Tech Adaptation: Adapting its business model and loyalty program to enhance mobile, delivery, and digital experiences presents an opportunity after COVID-19 impacts exposed gaps. Besides, partnerships with third-party delivery apps and upgrades like tap-to-pay can make ordering and payment more convenient.

Threats – Buffalo Wild Wings SWOT Analysis

Competition: With casual dining chains like WingStop and pizza chains expanding wing options, competition is steep. Buffalo Wild Wings relies on the dine-in experience, but smaller chains exploit delivery and takeaway. In the last three years, Wingstop opened 169 net new restaurants compared to 3 for Buffalo Wild Wings.

Rising Costs: As a wing-centric chain, Buffalo Wild Wings faces significant cost pressures from poultry. In 2023, bone-in wing costs spiked over 30%. While costs eased in late 2023, inflation across wages, ingredients, and operations remains a significant threat. As a result, if we look at the data from the last three years, SG&A expenses were up 31%.

Workforce Issues: Like all restaurants, hiring and maintaining staff has become more challenging post-pandemic. As a result, costs to attract and retain cooks and servers are up and impact store margins. In 2023, rising labor costs and wing prices led to a 21% restaurant-level margin decline despite higher revenue.

[Bonus Infographic] SWOT Analysis of Buffalo Wild Wings

Recommendations for Buffalo Wild Wings

Here are some recommendations for the Buffalo Wild Wings for the coming years.

- Prioritizing foreign growth in Latin America and Asia represents a significant growth opportunity, expanding its customer base in regions with rising wing consumption.

- Focus innovation efforts on frictionless ordering, personalized promotions, and delivery network expansion to boost retention and order values.

- Locking in longer-term contracts at fixed prices could hedge the risk of price spikes and stabilize margins over multi-year terms.

- Given inflationary wage pressures, analyze store-level labor deployment shift scheduling and consider rising automation to improve workforce productivity without sacrificing hospitality.

Frequently Asked Questions (FAQs)

Who is Buffalo Wild Wings biggest competitor?

Darden Restaurants is Buffalo Wild Wings biggest competitor.

Is Buffalo Wild Wings a brand?

Yes, Buffalo Wild Wings is a brand.

Final Words on Buffalo Wild Wings SWOT Analysis

While Buffalo Wild Wings remains strong competitively due to its unique wing-centric menu, sports bar atmosphere, customer loyalty, and expanding global footprint, intensifying competition in the casual dining space along with rising inflationary pressures around wages and critical ingredients like chicken wings threaten margins if not effectively mitigated through tighter cost controls, supplier contracts, and tech-enabled labor optimization.

References

- Wikipedia contributors. (n.d.). Buffalo Wild Wings. Wikipedia.