The movie theater industry is one of the most influential industries in the world with its color, stories, and dreams that reach every person in the world in one way or another. And we will get to know the behind stories of the business part of it in this movie theater industry SWOT analysis.

Movie Theater Industry Overview

The movie theater industry traces back to 1905 when the first theater opened in Pittsburgh, charging just 5 cents admission on wooden folding chairs. Theater attendance exploded in the 1920s as films transitioned to sound, color, and early blockbuster stories.

The industry employs over 150,000 people, ranging from minimum-wage theater staff to executives at major cinema chains like AMC and Regal, comprising over half the screens nationally.

Competitors in Movie Theater Industry

PVR INOX | Cinepolis | AMC Theatre | Regal Cinemas | Wanda Cinema

Did You Know?

Popcorn became popular in movie theaters during the Great Depression because it was cheap to produce and sell.

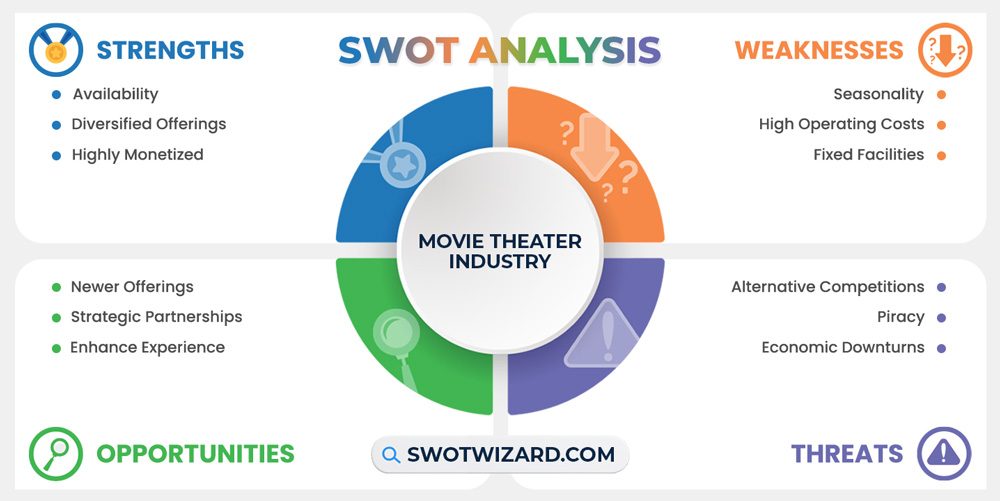

Strengths – Movie Theater Industry SWOT Analysis

Availability: Movie theaters remain highly accessible forms of out-of-home entertainment, with over 5,000 indoor theaters across the USA as of 2022. Despite closures in recent years, 63% of the population still lives within 10 miles of a theater on average, indicating continued nationwide infrastructure and availability, and this goes for most of the city areas in third-world countries, too.

Diversified Offerings: Theaters have expanded beyond movies to offer alternative content, including live sports, concerts, opera, video gaming tournaments, and private event rentals. Even concert broadcasts of bands like BTS or live streaming of NFL games have allowed theaters to diversify, generate incremental revenue, and drive new attendance.

Highly Monetized: While admissions are central, the box office accounts for just 44% of a theater’s total revenue. Profitable concession sales, which boast margins above 83%, account for another third. With rising menu prices and new upsold items like alcohol, theaters monetize patrons significantly beyond the sole movie ticket transaction through what’s often incremental consumer spending.

Weaknesses – Movie Theater Industry SWOT Analysis

Seasonality: Theater attendance closely tracks the calendar release schedule of the film industry. With peak seasons around holidays and summer when major blockbusters target openings, volume can fluctuate severely. If we look at the data, the box office plummeted 90% versus 2020 pre-pandemic levels, whereas the numbers climbed nearly 500% on tentpole releases.

High Operating Costs: Theaters face exceptionally high fixed overhead expenses, including costly real estate, debt burdens, and rising inflation on minimum wages and benefits. Additionally, studios claim 60-70% of box office revenue in early release windows under revenue-sharing terms, squeezing already slim theater margins.

Fixed Facilities: Purpose-built movie theaters offer limited adaptability, with permanent tiered seating, large screens, and projection/sound technology baked into infrastructure. While beneficial for core movie exhibitions, customizable space would allow more diverse live events, and ample square footage and layouts catered to moviegoers also reduce the feasibility of renovating many existing theaters for alternative tenants.

Opportunities – Movie Theater Industry SWOT Analysis

Newer Offerings: With declining costs for laser projection reaching under $100k, upgraded equipment allows theaters to deliver premium significant format experiences in more auditoriums. As per the data, IMAX screens now appear in over 1,700 global locations versus under 200 theaters in 2013, and expanded availability of enhanced audio, brighter 4K projection, and larger screens serve as a differentiator wooing audiences.

Strategic Partnerships: Joint ventures like AMC’s recent deal to show live sporting events with the NFL and ESPN leverage existing theater infrastructure for mutually beneficial programming. Besides, sports teams and leagues also value extending their brands to new environments, not to mention similar esports and concert partnerships, which further help theaters maximize use cases for their facilities during off-peak periods.

Enhance Experience: Delivering greater convenience and comfort grows satisfaction and loyalty among moviegoers. As for the opportunities, installations like recliner seating, expanded concessions menus, reserved ticketing options, and connected mobile technology aims to make trips to the theater more enjoyable. And customer-friendly improvements that elevate the overall experience beyond just the movie itself present an avenue to stabilize attendance.

Threats – Movie Theater Industry SWOT Analysis

Alternative Competitions: Streaming services and in-home entertainment divert audiences, with US households subscribing to 4+ platforms on average. In release schedule, instability jeopardizes theater attendance as studios increasingly prioritize streaming exclusives over theatrical windows for some titles, and 46% fewer films saw wide theatrical distribution in 2022 versus pre-pandemic.

Piracy: Camcording and illegal distribution threaten revenues, especially surrounding a film’s opening weeks that account for the large majority of box office gross. HBO Max saw more than twice as many views for Wonder Woman 1984 from piracy than legal streams in its first 24 hours of release. Without enforcement and prosecution, piracy technically empowers consumers with free but illegal alternatives.

Economic Downturns: Entertainment spending often falls victim to the broader economy, and a severe recession would constrain disposable income flows to theaters. The 2008 financial crisis contributed to a nearly 20% three-year slide in theater revenues, and the recent rising inflation and fears of depressed consumer confidence have already lowered investors’ appetite for cinema stocks.

[Bonus Infographic] SWOT Analysis of Movie Theater Industry

Recommendations for Movie Theater Industry

Here are some recommendations for the movie theater industry for the coming years.

- Theaters should continue investing in large format screens, high-quality projections, luxury seating, and amenities that patrons can’t easily mimic at home.

- Seeking partnerships with sports leagues, gaming/esports tournaments, musical acts, and other media fills dark times and amortizes high operating costs.

- Utilize demand-based pricing with discounts or surcharges for tickets and concessions based on showtime attractiveness.

- Diversify concession menus with higher quality and expanded food options while still optimizing efficiency.

Frequently Asked Questions (FAQs)

Which country has more theater?

Saudi Arabia has more theater.

What is the most popular movie theater?

AMC Theatres is the most popular movie theater.

Final Words on Movie Theater Industry SWOT Analysis

While the movie theater industry retains inherent strengths in its immersive theatrical experiences, it faces escalating competitive and economic threats requiring strategic evolution. By capitalizing on opportunities like subscription pricing, strategic content partnerships beyond film, and investments in modernizing its premium sight and sound capabilities, movie theaters can stabilize attendance and revenue flow.